Plans and Priorities

Page Navigation

- School District U-46

- Unite U-46: Bond Proposal

- Tax Information

-

Bond Proposal - Tax Information

Now is the time - Zero-Tax-Rate-Change

School District U-46 has followed responsible planning and fiscal management, allowing us to implement these recommendations and achieve our goals without changing our debt tax levy by using a combination of reserve funds and a zero-tax-rate-change bond referendum.

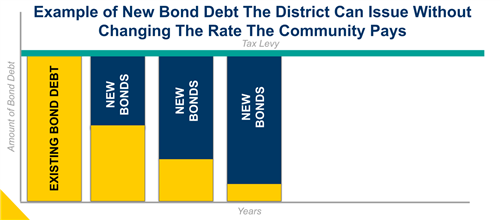

The referendum asked voters for their approval to issue $179 million in school building bonds to make safety and security improvements, renovate and replace building infrastructure, add classrooms for early childhood education, improve accessibility, and construct STEM labs and classrooms. This can be accomplished with a zero tax rate increase by “swapping” old debt with new debt. As the district pays off the existing bond debt, it can issue new bonds for facility updates. Bonds are commonly known as loans or capital debt. You can see this "swapping" represented in the section of navy blue in the following graphic:

If the referendum had not been approved in April 2023, the District’s debt tax levy would have gone down while the needs of our buildings would have continued to increase. Making future building updates most likely to require a tax increase for the local community. This was a unique opportunity to complete updates without changing the rate homeowners pay for building updates.